Let’s Establish Your Risk Number

It’s a precise, mathematical way to find out if you’re invested correctly.

We all know that higher-risk investments can bring greater rewards—but they also carry a greater potential for loss. Some of us love the thrill of high stakes, while others want security. Deciding how much risk to take often comes down to “going with your gut,” which is hardly a precise indicator.

Understanding your risk-reward tradeoff is essential to properly building your portfolio.

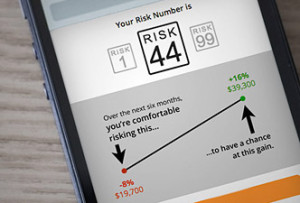

Since your investments should mirror your risk tolerance, wouldn’t it be nice if there were a way to calculate your exact risk-reward position and give it a numerical value—a Risk Number? Thankfully, there is, and it’s based on the academic framework that won the Nobel Prize for Economics.

Your personal Risk Number quantifies the investment gains you’d be content with—and the losses you could tolerate and still get to sleep at night.

Capturing your Risk Number and evaluating your investments is as easy as 1-2-3.

- Start the simple 2-minute questionnaire. You’ll find straightforward questions about your financial goals, portfolio and different risk scenarios.

- Answer each question carefully. You want to be certain your Risk Number is solidly based on accurate information.

- Receive a complimentary analysis. Along with your personal Risk Number, we’ll provide a 6-month simulation of probable gains and losses for your current portfolio.